Property Market info

At Think Slovenia we work with a broad range of investors in Slovenian property from private purchasers of holiday homes to investors focusing on Slovenia property development or on Slovenia’s tourist and long term rental markets. Our specialism is on Slovenia’s tourist and residential property markets but we have capabilities and partnerships that can help investors unlock all types of Slovenian property and help you to access up to 25,000 properties on the market in Slovenia. This page gives a general background to Slovenia property, but our service is tailored to every client’s unique circumstances. Please see our services for an introduction to the Slovenian real estate services we offer or email us to discuss your requirements. Resources for commercial investors / developers can be found here. For those needing information on residency applications in Slovenia connected to real estate investment please see our Slovenia residency and work permit guide.

Historically with its strategic geographical position, proximity and interdependence with Austria and Italy, Slovenia was the most prosperous member state of the former Yugoslavia and indeed of all the European communist states. Slovenia gained its independence from Yugoslavia in 1991 and made rapid progress to transform itself into a modern European market economy with well-developed infrastructure and a well-educated work force. Slovenia’s economic performance following EU accession in 2004 was impressive and the country was the first of the new EU entrants in 2004 to join the Euro in January 2007. More general information on Slovenia its economy and regions can be found here. Click here for a simple guide in English to Slovenia's tax regime.

The Slovenian Economy - Key indicators

GDP per capita (LCU) in 2024

31,490 EUR

Inflation in 2024

2.1 %

Growth in GDP in 2024

1.6 %

Exports of goods and services in 2024

61,5 billion EUR

Projected annual GDP growth for 2025

2.6 %

Imports of goods and services in 2024

69,1 billion EUR

% share of GDP 2023

2.3 %

Unemployment in 2024

5.2 %

Agriculture

1.8 %

Major industries

Wood products, textiles, chemicals and electronics

Construction

5.1 %

Main agricultural products

Wheat, sugar beets, cattle and sheep

Industry

30.2 %

Main exports

Machinery, equipment & finished products (chemicals and food)

Services

62.9 %

Trade partners

Over 77,1% of exports are to the countries of the EU

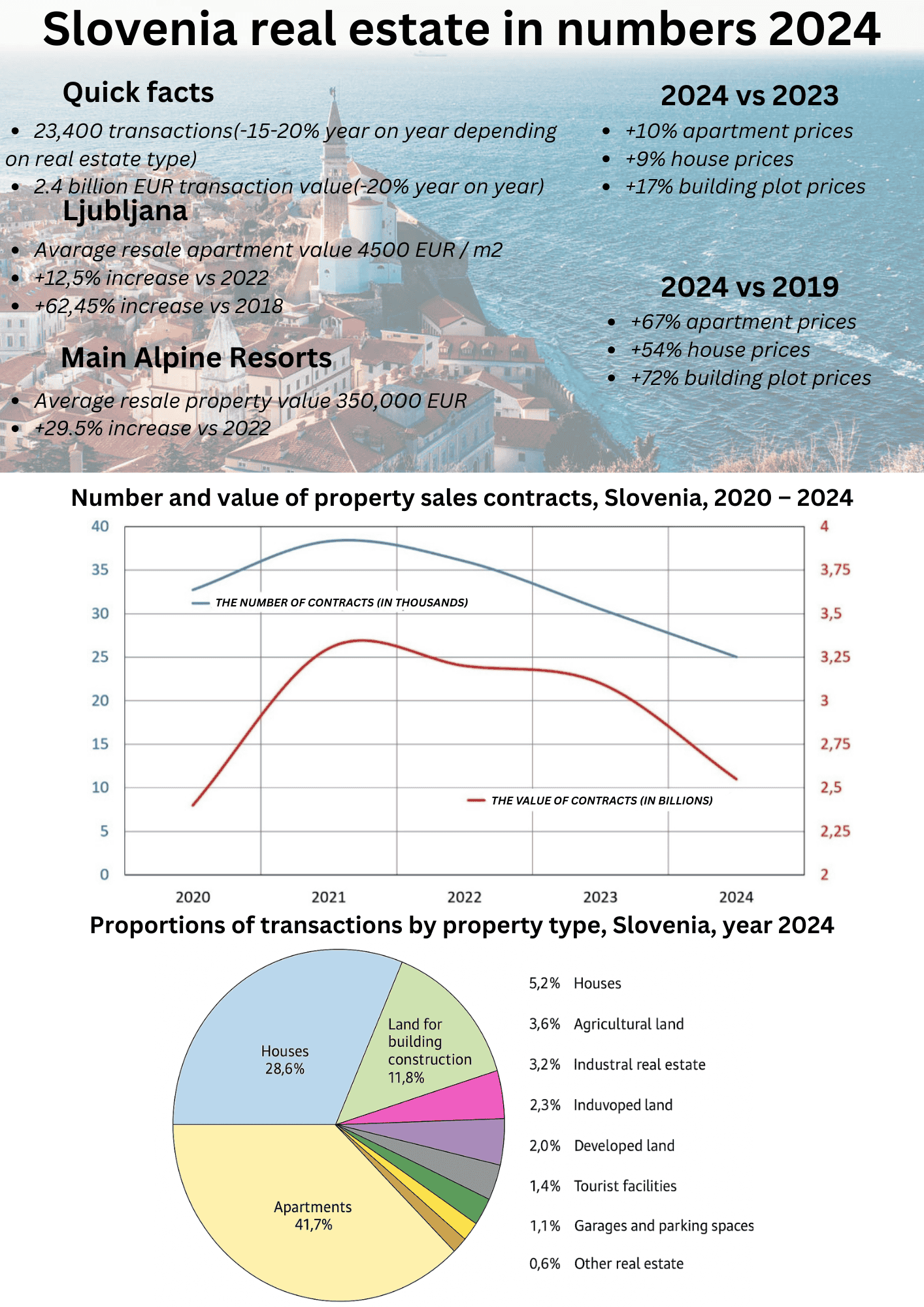

After a period of decline in 2023 and 2024, Slovenia’s real estate market showed a clear turnaround in the first half of 2025. Transaction volumes increased markedly for the first time in three years, while prices continued to rise at a steady pace. Nationwide, the number of apartment sales rose by around 30% compared to the second half of 2024, while house sales increased by about 20%. Sales of building land also recovered modestly, up by around 15%. This rebound is largely attributed to lower fixed mortgage rates, high employment, and real wage growth, which have boosted buyers’ purchasing power. On the pricing side, the upward trend remained stable. In the first half of 2025: Apartment prices rose by approximately 6%, house prices increased by around 4%, and building land prices edged up by about 2% compared to the second half of 2024. At the national level, the median price for existing apartments surpassed €3,000 per m² for the first time, reaching €3,070 per m². In Ljubljana, the median price climbed to €4,890 per m², nearly five times higher than a decade ago, and on the coastal region to €4,760 per m². The median price for houses stood at €180,000, while building plots averaged around €55 per m² nationally, with prime plots in Ljubljana selling for €469 per m². Historically there was a period of prolonged growth in the Slovenian real estate market following the global financial crisis of the late 2000s which had a significant impact on the Slovenian property market which prices reducing 15-20% below pre-crisis levels by 2014 and only returning to their 2008 peak in 2016 and growing steadily until the Covid-19 pandemic. Ljubljana and the leading coastal and mountain resorts remain the most expensive parts of the country to buy in, however in the last few years there has been some flattening of the price differentials between the cheapest and most expensive areas. This said there is still a wide variation in prices charged for similar properties and there are occasional bargains to be found - especially for rural mountain properties - which is why we always recommend our clients let us undertake a bespoke search against their criteria, so they understand the extent of what is on the market that suits their needs. A particularity of the Slovenian market is the relatively low level of transactions per capita meaning that the supply of properties on the market is limited in many areas and property fitting defined criteria can be hard to find. The statistics chart below is based on the last full year Land Surveying Authority (2024) real estate report issued in April for the previous year:

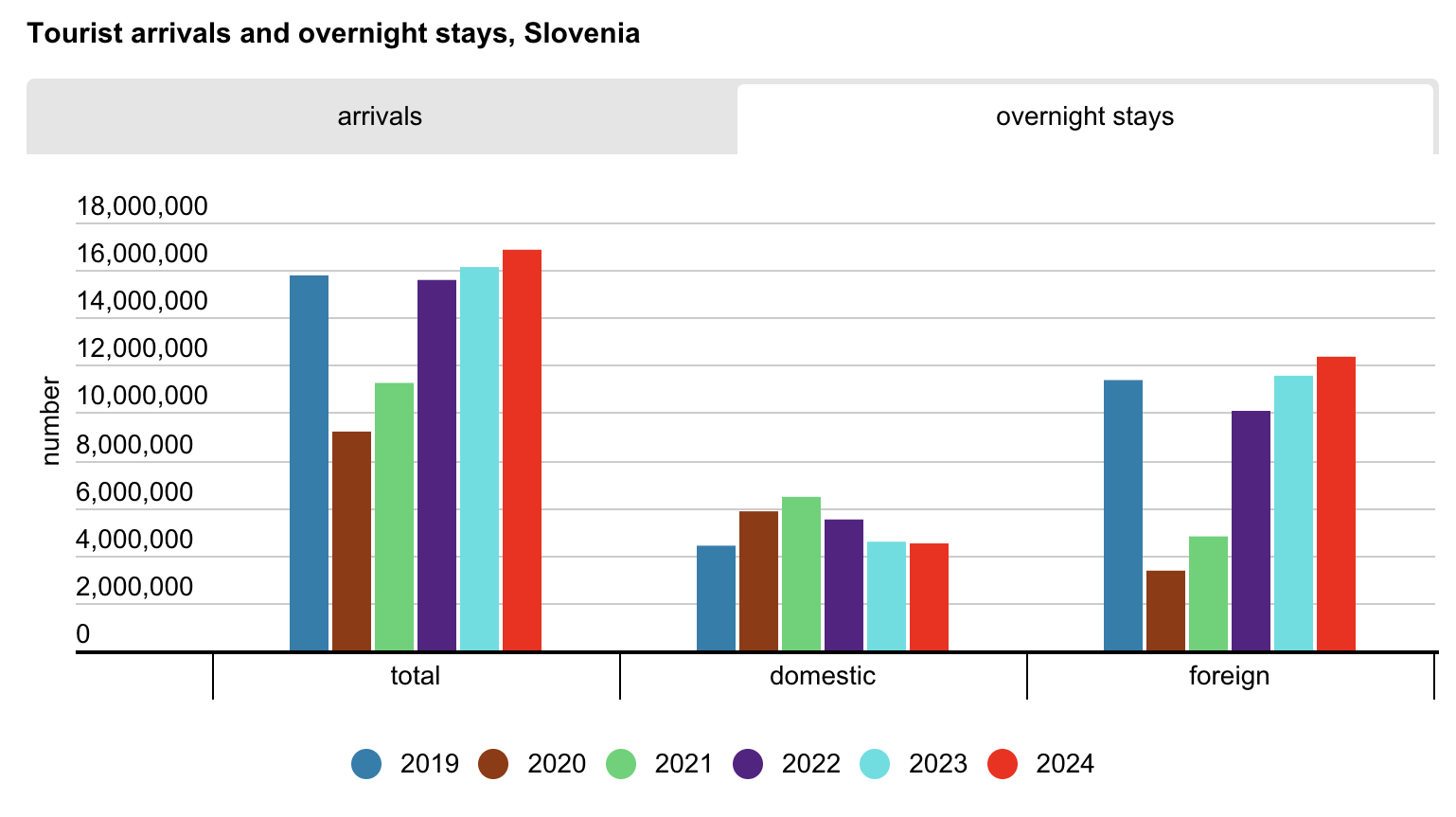

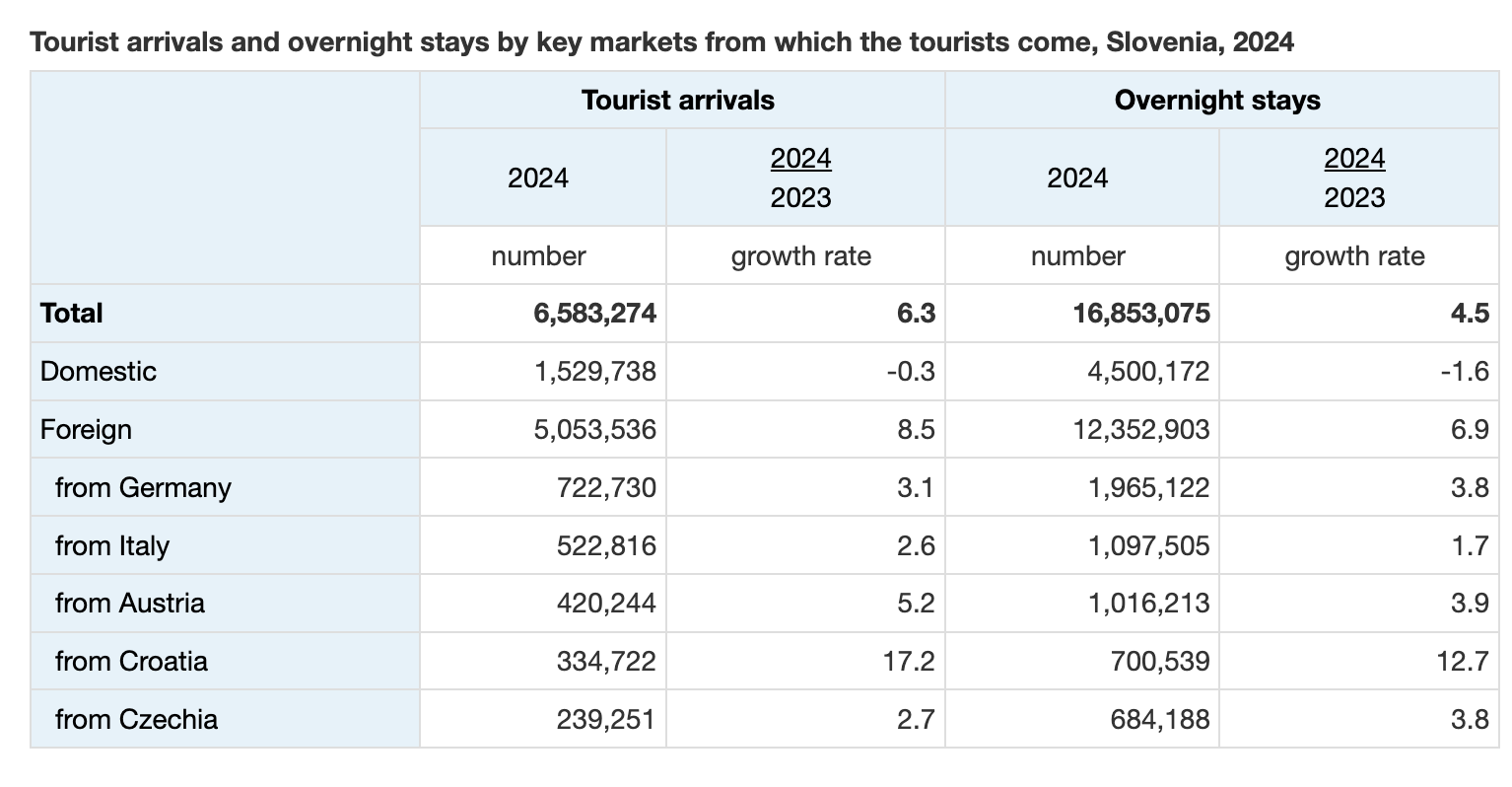

Slovenian tourism experienced its best year yet in 2024, surpassing all previous records. Overnight stays increased by 5% compared to 2023—the previous record-holder—and by 7% compared to 2019. Nearly 6.6 million tourists visited the country, accounting for approximately 16.9 million overnight stays, with August seeing the highest number. The years 2017 to 2019 were previously considered peak years for Slovenian tourism, characterized by substantial growth across various metrics and regions. Tourism has consistently been a bright spot in Slovenia's economy, showing resilience and a steady upward trajectory prior to the pandemic. The resurgence in tourism in 2023 can be attributed to Slovenia's appealing characteristics aligning with current tourism trends, such as green and active holidays. This growth has been bolstered by ongoing improvements in tourism infrastructure, as well as effective promotional efforts by the country and individual regions. This upward trend is particularly relevant for potential buyers of holiday homes in Slovenia, as many tourist areas have witnessed property value increases that outpace market averages. The improving conditions for tourist property rentals further enhance the attractiveness of investing in Slovenian real estate.

Generally the property purchase process in Slovenia is quick and straightforward with an efficient and comprehensive Land Registry system. As in most countries the price of property in Slovenia is negotiable and the first stage in the purchase process is for parties to agree the price and other main conditions of the sale. We always recommend formally surveying properties prior to purchase to identify issues with the building itself, but also with legal and titular matters such as access rights and compliance with building regulations. This is particulary important since the introduction of the Construction Law in 2018 and subsequent update in 2021 which introduced many measures to reduce levels of unpermitted building. We can arrange surveys for buyers of properties on our site but also for other buyers who may need assistance in purchasing a property they are purchasing independently. In most cases once a price is agreed a main sales contract is drafted which outlines the core terms of the sale and obliges each party to complete the sale within a given time frame. Usually the signature of the contract is followed by payment of a deposit of 10% of the purchase price. It is advisable that the deposit is held by an independent third party such as a notary. In some cases a preliminary contract is signed to agree terms relating to the payment of the deposit and the main sales contract is signed later. The deposit has a special status under Slovenian law meaning that the buyer will lose it if he is responsible for the sale not completing and the seller is obliged to return the deposit and pay the buyer the same amount again if he is responsible for non-completion. The signature of contracts can be done remotely or usually more advisedly face to face at a notary using the notary contractual format which offers buyers and sellers alike additional legal protections in the event of a dispute. Before a main sales contract can be signed key paperwork needs to be obtained often including a certificate about the intended usage of the real estate in question and for foreign buyers, Slovenian registration and tax identification numbers. In the event of the real estate having special status of some sort (e.g. agricultural land / located in a National Park / protected status) various documents must usually be obtained before signing a main sales contract. Land Registry searches to check the ownership status of the real estate should be conducted before signing the contracts and contracts should be carefully checked by a specialist and translated if appropriate, although unless the translation is court certified it will be the Slovenian version of the contract that must be signed. Once the main sales contract is signed and any contractual impediments to the completion of the sale resolved, the sales tax can be paid on the transaction (2% sales tax for resale properties, VAT payable on new properties / some land types, capital gains tax payable in some circumstances). Once the property tax is paid and any other impediments to completion of the sale removed, the seller’s signature on the contract is certified by a notary and once notary certification is complete, payment of the outstanding purchase price can take place. Buyers should be careful to ensure that before payment, the certified version of the main sales contract is held securely by a third party and / or they are in possession of a copy of the certified contract. After payment the buyers or their representative will need a copy of the certified contract in order to make a Land Registry inscription of the ownership and possession rights as laid out in the sales contract, which should happen as soon as possible after the contract is certified and payment made. If necessary notations can be placed in the Land Registry between contract signature and payment to ensure that there are no changes to the Land registry status prior to Land Registry inscription of the buyer's ownership rights. Real estate agency commission in Slovenia by law is a a maximum of 4% + VAT (VAT at 22%) of the agreed purchase price for the real estate. Common practice in Slovenia is for the agent's fees to be paid by the sellers, with sellers often requiring the buyer to pay a share of the sales costs as a condition of the sale, usually equal to 2% of the sales price and made in the form of payment of the property sales tax (DPN). However other structures in terms of agency fees and sales costs can and do exist and can be assessed by the buyer in the context of the overall package / price agreed for the chosen real estate. Parties usually share the cost of contract drafting by notary or lawyer, whilst sellers generally cover costs of certification of the sales contract by a notary and Capital Gains Tax, if relevant. Buyers usually pay for Land Registry inscription, cost of money storage and pre-purchase Land Registry annotations where relevant. Translation of documents where appropriate is paid by the party requiring translation. The final stage of the process is to arrange the hand-over. Usually for Slovenia property this takes the form of a face to face meeting at the property where keys are handed over, meter readings are taken and a handover record signed giving the buyer total responsibility for real estate. Once you’ve got the keys in hand the real work starts! Please see our Slovenian Property Renovation and Property Management sections for more details of how we can help you once you have purchased a property – we have a range of services to help you renovate, furnish, let and manage your Slovenian property.Offers, surveys & negotiations

Contracts & deposit

Sales documentation

Tax & notarization

Land registry inscription

Costs & handover

Complex planning regulations and procedures, availability of credit and various consumer protection measures can make property development in Slovenia a challenging enterprise. On the other hand in some ways it is less competitive than some other markets and the availability of skilled trades / craftsmen is good. Prospective developers should also bear in mind that the relatively strong culture of self building in Slovenia means that market does not always price the risk and work involved in management of the development / renovation of Slovenian property as highly as some other markets. We have worked with a wide range of developers and assisted clients with a very broad range of developments in Slovenia. Please click for our dedicated page for renovations, our page for professional developers / investors or alternatively contact us to discuss your individual requirements.

The residential rental market is smaller on a per capita basis than many Western European countries due to the high levels of home ownership in Slovenia. This said the rental market is buoyant in Ljubljana, with its large student population with gross yields of 3-6 % achievable. Ljubljana remains by far the biggest rental market in Slovenia with around 40% of long term rental transactions, up to two thirds of which are in studio / 1 bedroom apartments of under 60m2. The tourist rental market is also of interest to many foreign investors with gross yields of circa 10% possible for prime properties in and around the main Slovenian tourist resorts and with some of the mountain areas offering genuine year round rental potential. We recommend all potential investors interested in Slovenian property rental for tourism to take advice prior to purchase and to be aware of the procedures for registering / setting up for tourist rental. Please click here for more information on Slovenian property rental and management.